SEVILLA, SPAIN: Pakistan’s finance minister Mohammad Aurangzeb has called for urgent and coordinated global action to strengthen the international financial architecture in line with the principles of equity, solidarity, and inclusivity.

He was addressing the plenary session of the fourth international conference on financing for development held in Sevilla, Spain.

Mohammad Aurangzeb welcomed the renewed resolve demonstrated through the ‘Compromiso de Sevilla’ and appreciated its practical and forward-looking proposals.

These include pledges to double support for domestic resource mobilisation, reverse aid cuts, increase concessional financing through new metrics beyond GDP, expand the lending capacity of multilateral development banks, scale up local currency lending, and re-channel unutilised Special Drawing Rights through structured frameworks.

He called for early implementation of these commitments, particularly in the area of debt reform, including the establishment of an institutional platform for liquidity and debt management support, the creation of a borrower-focused platform to elevate the voice of developing countries, and the initiation of an intergovernmental process under the UN to address gaps in the existing debt architecture.

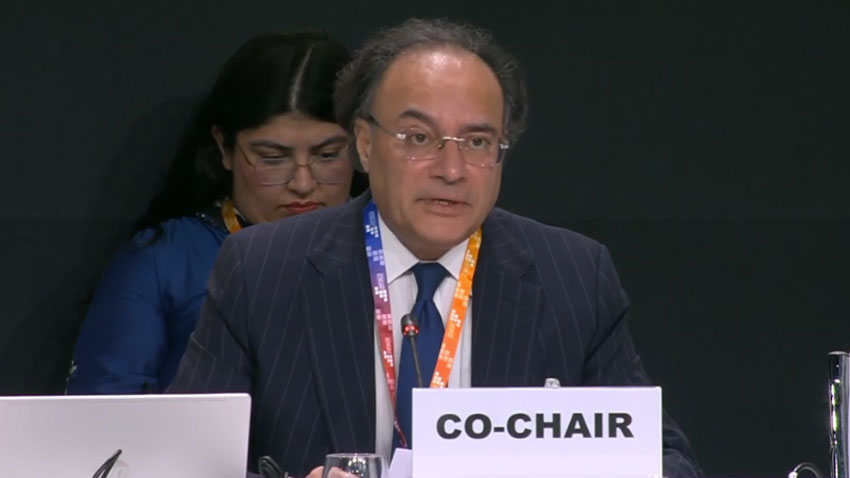

Earlier, the finance minister co-chaired the multi-stakeholder roundtable 2 on “leveraging private business and finance” alongside Canadian deputy minister of international development, Christopher MacLennan.

The session examined how private finance, innovation, and investment can be more effectively mobilized for sustainable development and economic resilience.

Mohammad Aurangzeb emphasized that public resources alone cannot bridge the vast financing. He said private finance holds the key to unlocking development at scale.

He called for decisive actions to improve domestic resource mobilisation, deepen capital markets with SDG-linked instruments, and create policy environments that attract and de-risk private capital in critical sectors such as climate resilience, housing, and SME finance.

The finance minister highlighted the importance of regulatory coherence, predictability, and targeted incentives to enable private investment.

He stressed the need to mainstream mechanisms such as credit guarantees, outcome-linked bonds, debt-for-climate swaps, and catalytic first-loss instruments, urging that public funds should be used strategically to leverage greater volumes of private and philanthropic capital.

Mohammad Aurangzeb also called for scaling up multilateral support for blended finance and technical assistance, and for embedding innovative financing tools into national SDG strategies and investment frameworks.

He emphasized that sustainable development requires an international financial system that is fair, inclusive, and responsive to the real needs of developing countries.

He reaffirmed Pakistan’s commitment to the principles of the Compromiso de Sevilla and to working collaboratively with the global community to ensure that no country is left behind in the pursuit of shared prosperity and sustainable progress.